They say there’s no place like home, but as we get older and perhaps face health issues, looking after ourselves and our homes can be stressful – in both practical and financial terms. Intended Wealth can help you navigate the personal and financial decisions ahead to plan a future that works for you and your loved ones.

No place like home

Planning ahead can reduce the stress

When the time comes that you need a helping hand, your options for aged care help include in-home services or residential care. Your GP can help you decide what level of care you may need and is likely to recommend a free assessment with an Aged Care Assessment Team/ Service (ACAT or ACAS). This assessment is required before you can access any government-subsidised services, which may include residential care or in-home services such as domestic assistance, personal care, meal services and home nursing.

While you may not need aged care services right now, it’s a good idea to consider your options and discuss your preferences with your family. With an agreed plan in place, you can be confident that the best decisions will be made at the appropriate time. Without some forward planning, fewer options may be available to you when you need them most.

Your financial health is important, too

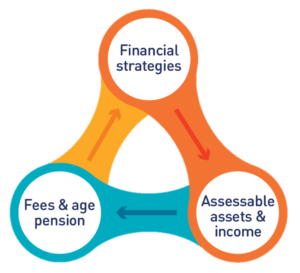

One of the key considerations of planning ahead for your aged care is looking at financial strategies to ensure you have sufficient cash flow to cover the projected costs. Just some of the important issues that may need to be considered include:

- Should your family home be kept, sold or rented?

- How are your Centrelink or Veterans’ Affairs benefits affected?

- Do you – or could you – qualify for concessions on accommodation or home care services?

- What is the best way to pay for your care?

What effect may your plans have on your estate? - How do you best manage any tax implications?

Searching for services?

myagedcare.gov.au

a comprehensive government resource to help find the care that’s right for you

ACAT/ACAS 1800 200 422

free aged care assessment is required before you can access government subsidised services

How much will care cost?

Fees for residential care will include accommodation payments, which can be an upfront lump sum, a daily payment or a combination of both:

- Refundable accommodation deposit (RAD) – a lump sum payment that is refunded to you or your estate, unless you ask for other fees to be deducted or have outstanding fees when you leave. RADs vary between different aged care facilities.

- Daily accommodation payments (DAP) – think of this as rent for your accommodation. It can also be used to cover interest on any unpaid RAD.

You will also be asked to pay for:

- Daily care fees – fees towards the cost of your care including nursing, meals, laundry, cleaning and electricity. They are set at 85% of the basic single age pension or a higher means-tested fee if you have income or assets over specified thresholds. This amount is limited by annual and lifetime caps, currently $25,000 per annum or $60,000 indexed over your lifetime*. *Information current as at April 2016.

- Additional service fees – for extras such as special meals, hairdressing or newspapers, which may be offered as a package or on a user-pays basis. These fees typically range from $10 to $120 or more per day.

Moving In

When you accept a place in an aged care service, a Resident Agreement will detail the services provided and fees payable. While fees may be payable once the place is accepted, you will have 28 days to decide to pay your accommodation as a lump sum (RAD), a daily fee (DAP) or a combination of both. Your assets may need to be rearranged to cover these and future payments. If you receive Centrelink or Veterans’ Affairs payments, they must be notified of the change to your living arrangements as well as any relevant changes to your income and assets.

Covering the costs of your aged care

Your Adviser will discuss different strategies that can help you and your family decide on the best way to ensure you have a reliable and regular cash flow to cover the costs of your care. While the aim may be to maximise your pension entitlements, minimise fees and generate a good return from your investments – possibly including the family home – these are not independent objectives. Working with an Adviser who is experienced in this area, you will receive the guidance and support to make well-informed choices and take away some of the stress for you and your family.

An essential time to review your estate plan

If your living arrangements are changing, it’s important to consider the impact on your estate plans. A review will make sure that your affairs and your personal care will be managed to your own instructions and wishes. You should talk to your solicitor and your Adviser about:

- Your Will, which may need to be updated

- An Enduring Power of Attorney, so your affairs can be managed responsibly if you are no longer able to make those decisions yourself.

- Any investments, especially those with ‘death benefit’ nominations.

- An Enduring Guardianship, to cover decisions on your care and living arrangements if you are unable to do so.

As these documents and powers can only be put in place while you are deemed of sound mind, it’s wise to plan ahead.

Next Step

Start planning your Aged Care options, talk to us today.

Reach out today for a better peace of mind tomorrow